Welcome to the fascinating world of microcaptive insurance, where innovative risk management solutions are being unlocked. Microcaptives have become a hot topic in recent times, and for good reason. These small, private insurance companies are changing the game by offering businesses a tailored approach to managing their risks, making them a valuable tool for risk management and financial planning.

At the heart of microcaptives is the IRS 831(b) tax code. This specific provision allows eligible small insurance companies (with annual premiums under $2.3 million) to elect taxation on their underwriting income only, rather than their entire income. This tax advantage has made microcaptives an attractive option for businesses looking to gain more control over their insurance programs and enhance their overall risk management strategy.

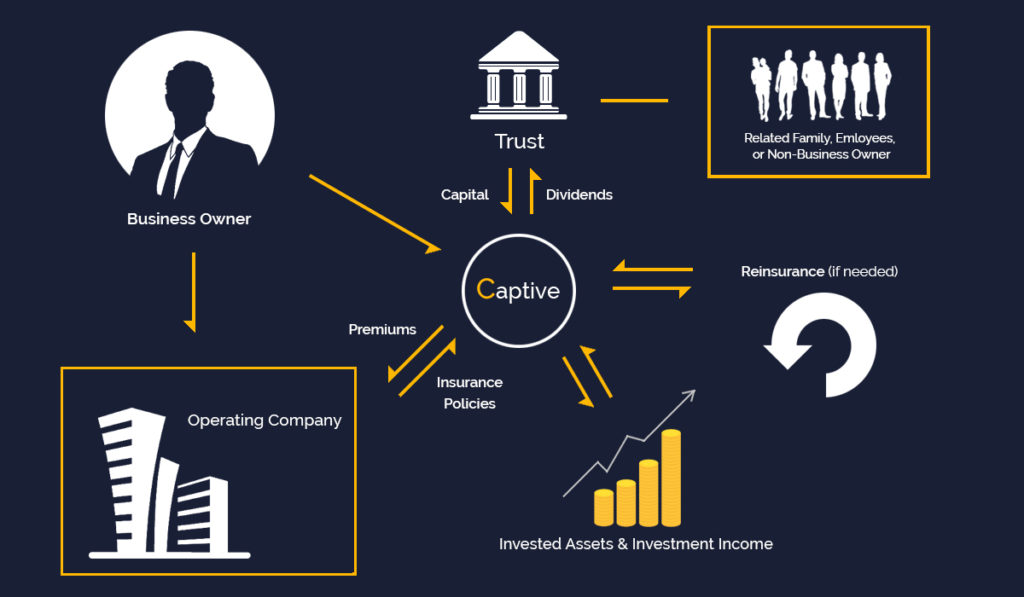

Captive insurance itself is not a new concept, but the emergence of microcaptives has opened up a world of possibilities for small and mid-sized companies. By forming their own insurance company, businesses can effectively self-insure certain risks, allowing them to take greater control over their coverage, claims, and ultimately, their financial stability.

So, if you’re curious to explore the innovative potential of microcaptives and learn how they can revolutionize risk management for businesses, join us as we delve deeper into this exciting realm. From understanding the intricacies of captive insurance to unraveling the benefits of the IRS 831(b) tax code, we’ll unveil the power they hold in providing businesses with powerful risk management solutions. Get ready for a journey that will transform the way you view insurance and risk.

The Benefits of Microcaptives

Microcaptives, also known as 831(b) captives, provide a range of benefits for businesses seeking innovative risk management solutions. By leveraging the IRS 831(b) tax code, these small captives offer a unique opportunity to effectively manage and mitigate risks.

One of the key advantages of microcaptives is their ability to tailor insurance coverage to address specific needs and risks faced by the business. Unlike traditional insurance policies, which can often be inflexible, microcaptives allow businesses to design customized insurance programs that align precisely with their risk profiles. This level of customization ensures that businesses can effectively address their unique challenges and protect their assets.

Moreover, microcaptives can also offer significant cost savings for businesses. By establishing their own captive insurance company under the IRS 831(b) tax code, businesses can take advantage of favorable tax treatment. This allows them to retain more of their insurance premiums and accumulate funds to cover potential losses. The tax-efficient structure of microcaptives can result in notable savings over time, making them an attractive option for risk management.

Additionally, microcaptives provide businesses with greater control and insight into their insurance programs. Acting as their own insurer, businesses can tailor their underwriting guidelines and claims processes to suit their specific requirements. This increased control allows for more efficient claims handling, faster response times, and ultimately, better protection against potential risks.

Overall, microcaptives offer businesses a powerful risk management solution with numerous benefits. From customized insurance coverage to cost savings and greater control, microcaptives have the potential to revolutionize the way businesses manage their risks and protect their assets.

Navigating the IRS 831(b) Tax Code

In the realm of microcaptives, understanding the IRS 831(b) tax code is crucial. This tax code provides a unique opportunity for businesses to establish captive insurance companies and unlock powerful risk management solutions.

By taking advantage of the IRS 831(b) tax code, businesses can set up a microcaptive, which is an insurance company that is owned by the business. This allows the business to retain a portion of its own risk, rather than relying solely on traditional insurance coverage.

One key factor to note is that the IRS places certain restrictions on microcaptives operating under the 831(b) tax code. For example, the annual premium limit for microcaptives is set at $2.3 million. Additionally, there are specific requirements regarding the types of risks that can be insured.

Navigating these regulations is essential to ensure compliance and maximize the benefits of establishing a microcaptive. It is advisable for businesses to seek the guidance of professionals well-versed in the intricacies of the IRS 831(b) tax code to ensure proper adherence to the rules and regulations.

In conclusion, the IRS 831(b) tax code offers businesses a unique opportunity to establish microcaptives and enhance their risk management strategies. By understanding the provisions and requirements outlined in this tax code, businesses can navigate the regulatory landscape and unlock the powerful solutions that microcaptives provide.

Unlocking Powerful Risk Management Solutions

Microcaptives, also known as 831(b) captives, offer businesses innovative risk management solutions while providing tax advantages under the IRS 831(b) tax code. Through the utilization of microcaptives, businesses have the opportunity to take control of their insurance needs and customize coverage specific to their industry and risk profile.

One key advantage of microcaptives is the potential for cost savings. By forming their own captive insurance company, businesses can access coverage that may be more tailored and cost-effective than traditional insurance options. This allows them to allocate resources efficiently and effectively manage their risk exposure.

Furthermore, microcaptives provide businesses with greater flexibility and control over their insurance programs. Instead of being subject to the restrictions and limitations of the commercial insurance market, microcaptives enable companies to design and implement insurance policies that align directly with their unique risk profiles. This level of customization empowers businesses to address their specific needs, potentially leading to better risk management outcomes.

In addition to enhanced cost savings and flexibility, microcaptives offer businesses the opportunity for potential tax advantages. Under the IRS 831(b) tax code, qualifying microcaptives can elect to be taxed only on the investment income they generate, rather than the total premium income received. This favorable tax treatment allows businesses to optimize their financial strategies and potentially reduce their overall tax liability.

In conclusion, microcaptives present powerful risk management solutions for businesses. From cost savings and flexibility to potential tax advantages, these innovative captive insurance structures provide companies with the means to customize their insurance coverage, effectively manage their risks, and gain greater control over their financial outcomes. With the right approach, microcaptives can unlock new possibilities and help businesses thrive in an ever-evolving risk landscape.